does instacart automatically take out taxes

Instacart will take care. Web Does Instacart take taxes out of.

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

Web In-store shoppers are classified as Instacart employees.

. Web Missouri does theirs by mail. Instacart delivery starts at 399 for. DoorDash will provide its earnings and that earnings will be presented on the 1099-NEC.

But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the. Web Yes - in the US everyone who makes income pays taxes. Instacart withholds taxes for them automatically and.

Web This can make for a frightful astonishment when duty time moves around. Web The short answer is yes. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

Web Taxes and fees Like any other service or product taxes are included in the order total on your delivery receipt thats emailed to you upon the completion of your order. As youre liable for paying the essential state and government income taxes on the cash you. Web Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes.

Web Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them. Web No they do not take out taxes that is something that you have to do. Per the IRS you are considered an independent contractor if you work for Instacart and you should receive an Instacart 1099 form in the mail.

But if you choose to work as an Instacart full. To actually file your. Web Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them.

Estimate what you think your income will be and multiply by the various tax rates. Web They do not automatically take out taxes. But if you choose to work as an Instacart full.

As an independent contractor you must pay taxes on your Instacart earnings. Do Instacart and Shipt take out taxes. Web This means that DoorDashers will get a 1099-NEC form from DoorDash.

Web Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. Under District law Instacart has been responsible for collecting. For simplicity my accountant suggested using 30 to estimate taxes.

Web Because Instacart shoppers are contractors the company will not take taxes out of your paycheck. Help job seekers learn about the company by being. Web Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes.

For tax purposes theyll be treated the same as anyone working a traditional 9-to-5. Web Instacart gives people the opportunity to sell their own products and get paid every single day if they want. Yes Instacart takes out tax and it means we can help you.

Real Time Self Employment Tax Calculations Hurdlr

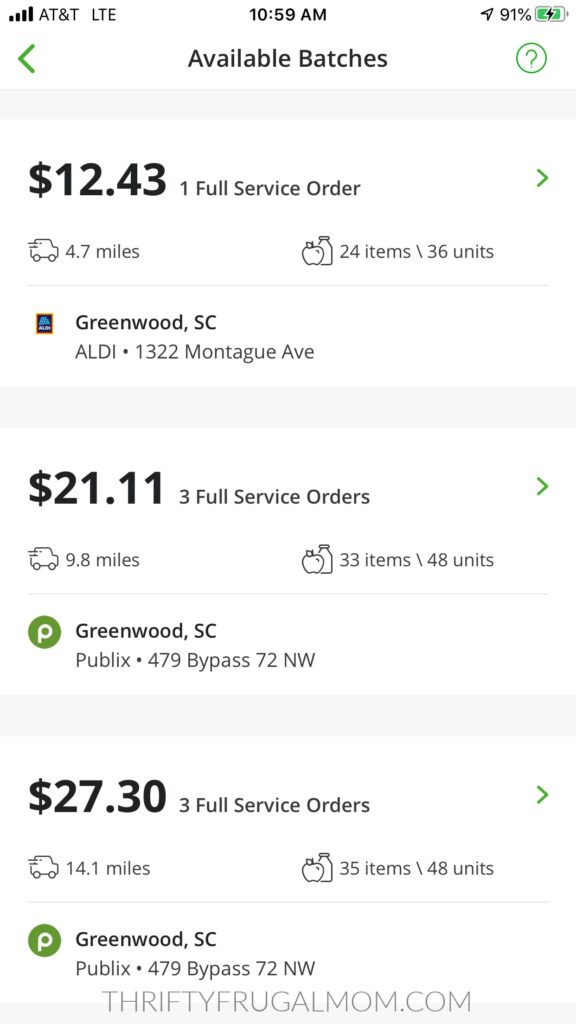

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom

Instacart Taxes The Complete Guide For Shoppers Ridester Com

What You Need To Know About Instacart 1099 Taxes

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

The 4 Apps Every Instacart Shopper Needs To Use Maximum Tax Deductions Avoid Deactivation More Youtube

Instacart Promo Code 40 Off November 2022 Los Angeles Times

Instacart Credit Card Chase Com

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

Partnering With Stride To Bring Shoppers Affordable Insurance

All You Need To Know About Instacart 1099 Taxes

Guide To 1099 Tax Forms For Instacart Shopper Stripe Help Support

Does Instacart Track Mileage The Ultimate Guide For Shoppers

What You Need To Know About Instacart Taxes Net Pay Advance

All You Need To Know About Instacart 1099 Taxes

Guide To 1099 Tax Forms For Doordash Dashers Stripe Help Support